- The module is useful when:

- Benefits

- See how it works

- More info

24iValue imitates the process of thinking and the actions a conventional expert uses to calculate deferred income tax and corporate income tax liability.

The system is much more than an online accounting guide, a tax liability calculator or a taxable income calculator as it will guide you step by step through the entire calculation process, in order to easily and correctly calculate taxes (deferred tax and UK corporation tax) even without extensive knowledge in this field.

This support is also very useful when you are familiar with a tax and just want to independently ascertain the correctness of the declared corporation tax liability.![]() Please note that at the moment the module Deferred Tax and Corporation Tax is dedicated only to the UK companies.

Please note that at the moment the module Deferred Tax and Corporation Tax is dedicated only to the UK companies.

Using 24iValue as a corporate tax calculator, you will minimize the risk of errors in your corporation tax and deferred tax calculation. The easy way to verify a tax liability will help you to calculate the amount of current income tax even a few times faster than traditionally.

This service will be very helpful when you do not know how to calculate deferred tax, because you do not do it often.

It will also help when you need to quickly calculate corporation taxes, but do not have much tax knowledge or you have already calculated it but do not have anyone who can check your calculation before you declare the amount to the tax office.

The system provides you with a conclusion document check of your calculation, which shows that you have kept due diligence when calculating the corporate taxes.

Do you know that ... ?

You will easily understand why calculation of deferred tax is necessary, if you treat corporation tax as a cost and you will follow the principle of matching of costs and revenues.

Income tax is a cost for companies and in theory, it should be equal to tax rate times the gross profit, but in practice it is computed on the taxable profit and therefore it is necessary to calculate deferred taxes in order to adhere to the income-cost matching principle.

Corporation Income Tax

I am an auditor and a business owner. In addition, as I keep my accounting books myself, I am familiar with the practical problems related to corporation tax calculation and payment of the right amount of tax liability. There are many differences between the balance sheet and the tax approach, which makes the risk of making errors high. That is why I think income tax is a very complex accounting area.

That is additionally troublesome with the frequency of making the calculation - even every month, while there are other accounting duties, are not there? The problems of calculating taxable profit and the required precision impact the time required for the task; however, even then we are not sure that our corporate tax calculation is correct.

The fear if we have managed to calculate our corporation tax correctly keeps us awake at night. At the end of day who is responsible for errors? To mitigate the risk, we have to hire external consultants, which is costly.

24iValue UK tax calculator has been designed primarily for those of us whose income tax calculation is not verified by anybody else and who are interested in mitigating the risk. Advanced knowledge is not required. Tips and questions that are displayed during the calculation of corporation tax with 24iValue lead users through the process with ease.

With 24iValue, you can verify on your own and independently what you have prepared. We will reduce the risk errors that will recur when we check calculation of corporation tax in a traditional way. As a matter of fact, we need no more information than we have in our books.

With 24iValue, you can save an entire day of work in a moment. That is a lot of time. The availability of the service 24 hours a day provides support around the clock and throughout the full year. When we have verified the corporation tax and printed the result and conclusion on its correctness from the 24iValue tax calculator, we can explicitly prove the due diligence exercised in income tax calculation.

Deferred taxes

During my twelve years of working as an auditor, I have often been coming across the calculation of deferred tax. The key problem is the multitude of differences between the balance sheet and the corporation tax approach. It is easy to get lost when identifying and calculating temporary differences or timing differences on the basis of which it is calculated.

Incorrectly calculated amounts of deferred tax asset or deferred tax liabilities, distort the financial result. Often we find it difficult whether a difference is temporary or not. This is intensified with the risk of simple mistakes like an incorrect sign.

When in doubt, the time spent for a tax accountant deferred income tax calculation may be difficult and time consuming without support of external consultants. Consultants do not always devote as much time as required and we do not have the habit since most often we calculate it only once a year.

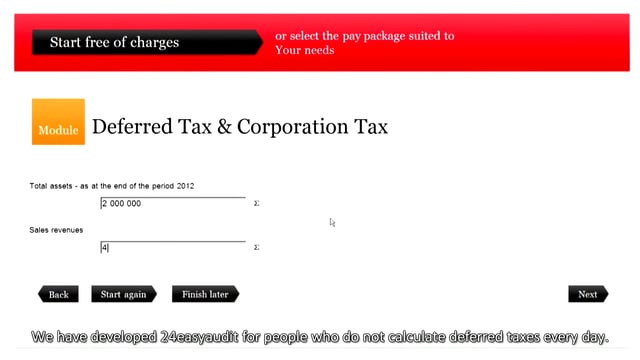

We have developed 24iValue for people who do not calculate deferred taxes every day. The deferred tax sub module is an intuitive deferred tax calculator. We have seen to it that not only standard temporary differences are incorporated, but also those that are encountered less frequently.

24iValue performs the entire taxes deferred calculation process in generating deferred tax assets and deferred tax liabilities. With the process, we understand what kind of timing or temporary differences are to be looked for and how they should be identified. It helps us verify the logic and completeness of the input temporary differences. Only the information available in the books of account is required. The entire process is intuitive and does not require any additional training.

The automatic calculation process and lower risk of error ensured by 24iValue may save an entire working day at a time. Additionally, the corporation tax and deferred income tax module and other modules are available on request so we have access to our consultant 24 hours a day, including printout of the result and recommendations.

See how it works

Deferred Tax & Corporate Tax